How to Deal with Bank Harassment: Steps to Protect Yourself

Are you facing constant calls and pressure from your bank for loan repayment? While banks have the right to recover loans, they must follow legal and ethical guidelines. If you are experiencing harassment, knowing your rights and the steps to take can help you deal with the situation effectively.

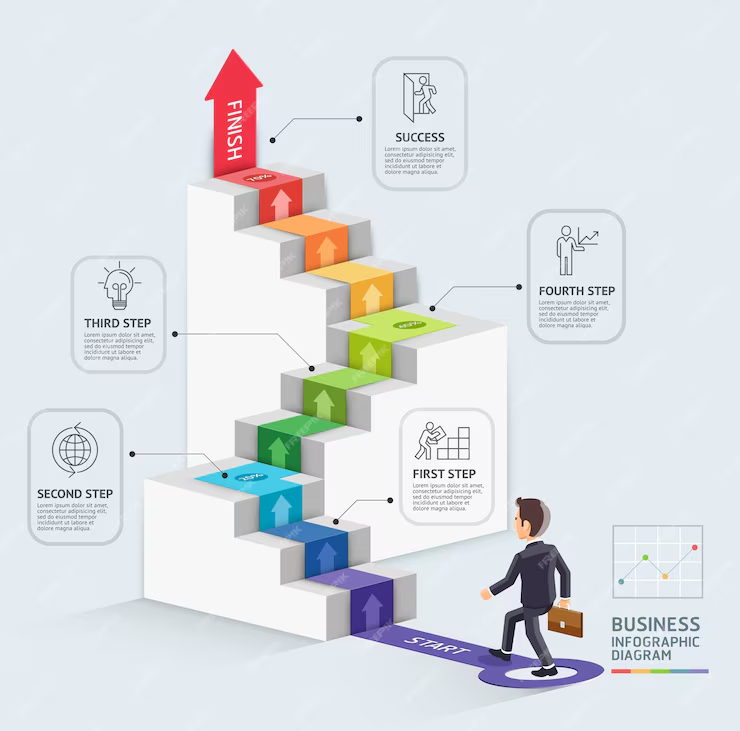

In this blog, we’ll guide you through the step-by-step process of handling bank harassment and protecting yourself legally.

What is Bank Harassment?

Bank harassment refers to unethical or aggressive tactics used by banks or recovery agents to recover outstanding dues. This includes excessive calls, threats, public shaming, and intimidation.

Example: If you have missed EMI payments, the bank should send formal notices but cannot harass you through continuous calls at odd hours or threats.

Step-by-Step Guide to Dealing with Bank Harassment

✅ Step 1: Know Your Rights as a Borrower

- Banks must follow RBI’s Fair Practices Code.

- Recovery agents cannot threaten or harass you.

- You have the right to negotiate or seek alternative repayment solutions.

✅ Step 2: Document the Harassment

- Keep records of all calls, messages, or visits from recovery agents.

- Note down the time, date, and content of the harassment.

- Record phone calls (if legally permitted in your state) as proof.

✅ Step 3: File a Complaint with the Bank

- Send a written complaint to the bank’s grievance redressal department.

- Mention specific incidents of harassment and demand a resolution.

- Keep a copy of all communication for reference.

✅ Step 4: Escalate the Complaint to RBI

- If the bank does not resolve your complaint, file a case with the Banking Ombudsman under the Reserve Bank of India (RBI).

- Visit the RBI Ombudsman website to submit your complaint online.

✅ Step 5: Seek Legal Assistance

- If harassment continues, consult a lawyer or file a complaint in Consumer Court.

- Banks violating RBI guidelines may face legal action and penalties.

✅ Step 6: Negotiate a Loan Settlement or Restructuring

- If you are unable to repay, request a loan restructuring or a One-Time Settlement (OTS).

- Always get the settlement agreement in writing to avoid future disputes.

Tips to Handle Recovery Agents Effectively

✔ Stay calm and do not panic. ✔ Never sign blank documents or give verbal commitments. ✔ Request all communication in writing. ✔ Avoid giving personal or financial details over phone calls. ✔ Block or report abusive calls to your telecom provider.

Legal Protections Against Bank Harassment

✅ RBI Guidelines: Banks must follow ethical recovery practices. ✅ Consumer Protection Act: Protects borrowers from unfair trade practices. ✅ Indian Penal Code (IPC): Harassment, threats, or defamation can lead to legal action.

Final Thoughts: Protect Yourself from Unfair Practices

If you are facing bank harassment, take immediate action by knowing your rights, documenting incidents, and escalating complaints through legal channels. Negotiating a structured repayment plan can also be a solution to ease financial stress.

Need Help Fighting Bank Harassment?

At Settle Loan, we specialize in protecting borrowers from unfair recovery practices and helping them find the best legal solutions.

📞 Call Now: 1800 309 1902

📧 Email Us: info@bankharassment.com